However, precisely due to the ‘blandness’, many of us ignore them as cornerstones of wealth accumulation until it is too late. Without further ado, let me share my 7 takeaways to bring us a step closer to become… The Millionaire Next Door! To be honest, the concepts introduced in the book are nothing mind-blowing or novel.

#Paw millionaire next door tv#

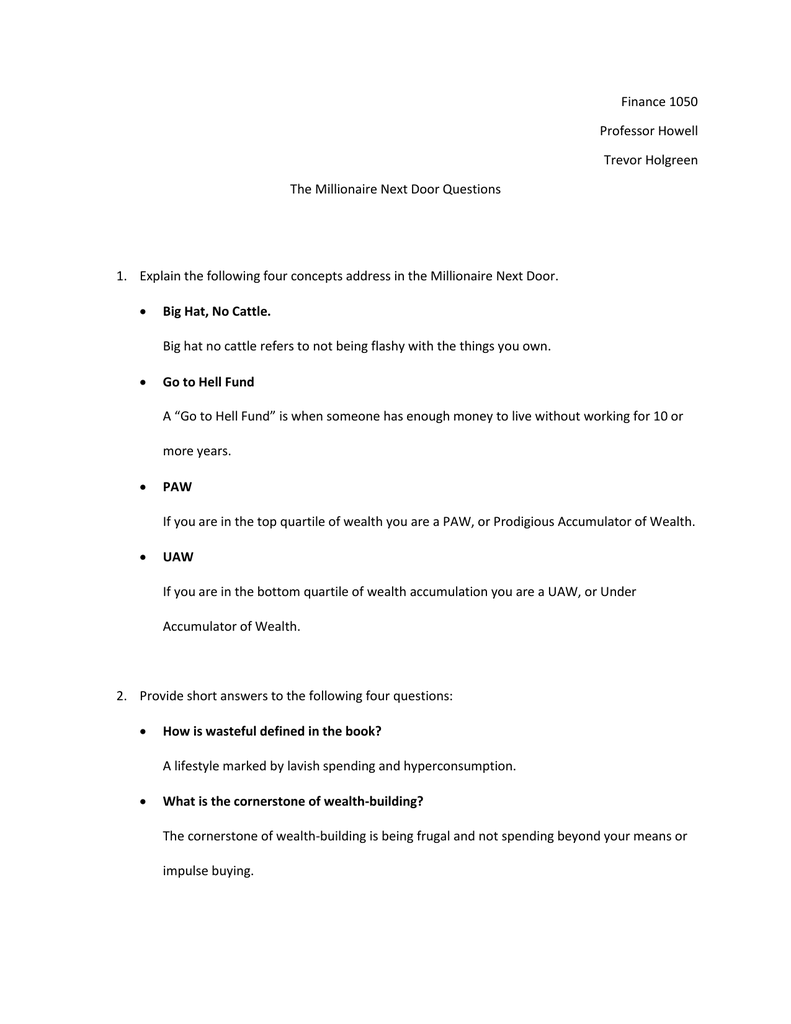

The revelation? The profile of a typical millionaire is very unlike what we assume through glamorous magazines and flashy TV shows. Originally published in 1996, this 25-year old book has been through numerous updates to shed light on what it truly means to be wealthy in the United States. A UAW has less than half the expected net worth.I recently sat down and finished one of the personal finance classics: The Millionaire Next Door by Thomas J. A PAW has more than 200% the expected net worth. This, less inheritance, is what your net worth should be. Dull-normal business consistently perform well for their owners.Īre you wealthy? Multiply age by pretax household income. They can take your business, but they can’t take your intellect.Ĭ. These professions are lower risk and more profitable (if limited in scalability). Millionaires encourage their children to become self-employed professionals. You can’t predict if someone is a millionaire by the type of business he’s in.ī. They are proficient in targeting market opportunitiesĪ. Tell your children that there are a lot of things more valuable than money.Ħ. Emphasize your children’s achievements, no matter how small, not their or your symbols of success. Always remember that your children are individuals (so don’t try to equalize inequalities of result) Let them run their own lives, and ask permission even to give advice. Stay out of your adult children’s family matters. Never give cash or gifts to adult children as part of a negotiating strategy Minimize the discussion of what children and grandchildren will inherit Don’t give them money until they have established a mature, disciplined, and adult lifestyle and profession Teach your children discipline and frugality Never tell them that their parents are wealthy The way to raise economically self-sufficient kids is the following: If your child was physically weak, you would not do everything for them and encourage them to eat and exercise less.ī. Parents foolishly strengthen the strong child and weaken the weak with assistance. Their adult children are economically self-sufficientĪ. Giving precipitates more consumption than saving and investing.ĥ.

Children who receive gifts tend to spend them. Their parents did not provide economic outpatient careĪ. They believe that financial independence is more important than displaying high social statusĤ. Most are buy-and-hold investors who supplement a broadly diversified portfolio with investments in areas of expertise.ģ. PAWs allocate twice as much time per month to planning their investments-but still only spend 8.4 hours a month doing so (vs. They allocate time, energy and money efficiently, in ways conducive to building wealthĪ. Millionaires operate on an annual budget, have clearly defined goals, and plan for the future.Ģ. Most have never paid more than $400 for a suit or $27,000 for a carī. There are seven common denominators among these Prodigious Accumulators of Wealth:Ī. The way to become rich is through discipline, sacrifice, and hard work. 80% of America’s millionaires are first-generation rich.

0 kommentar(er)

0 kommentar(er)